When locating a diamond in the ruff foreclosure when flipping houses, it’s super exciting! A foreclosure business can be very rewarding, whether it’s part or full time.

The knowledge you will gain in this post should help separate you from the competition. Besides, not all investors are looking for properties at the same time.

What is a Foreclosure? A foreclosure is a process in which a lender takes back a property after a borrower is in default. When this takes place it is known as an REO or Real Estate Owned.

Many Investors Are Fierce Competitors & Cash Buyers

When there is an all cash buyer, it can make it difficult on buyers needing to obtain a mortgage to purchase a foreclosure. Therefore, the quicker you locate these properties and lock up a contract, the better. You want to beat as many people investors to a contract as possible.

In saying this, sometimes with foreclosures, agents may wait to review all sales contracts with their client on a specific date.

If an agent prices the property competitively and there is demand, the agent may add a specific remark in the “broker remarks section” of the listing. The remarks may say something like: “submit your highest and best offer by date _________”.

The lender will then look at all contracts on the specific date and accept the contract that is in their best interest.

What Is An REO?

Real Estate Owned or REO refers to lenders such as banks or other institutions owning real estate. They are very common and abundant nationwide. The largest percentage of foreclosures is typically stacked on the segment of the market referred to as “entry level” homes.

In the height of the refinance boom in the early 2000’s, I appraised many real estate owned properties for banks. Many of these properties were in lower priced areas.

I became very intrigued when appraising REO properties & it made me want to flip houses myself…

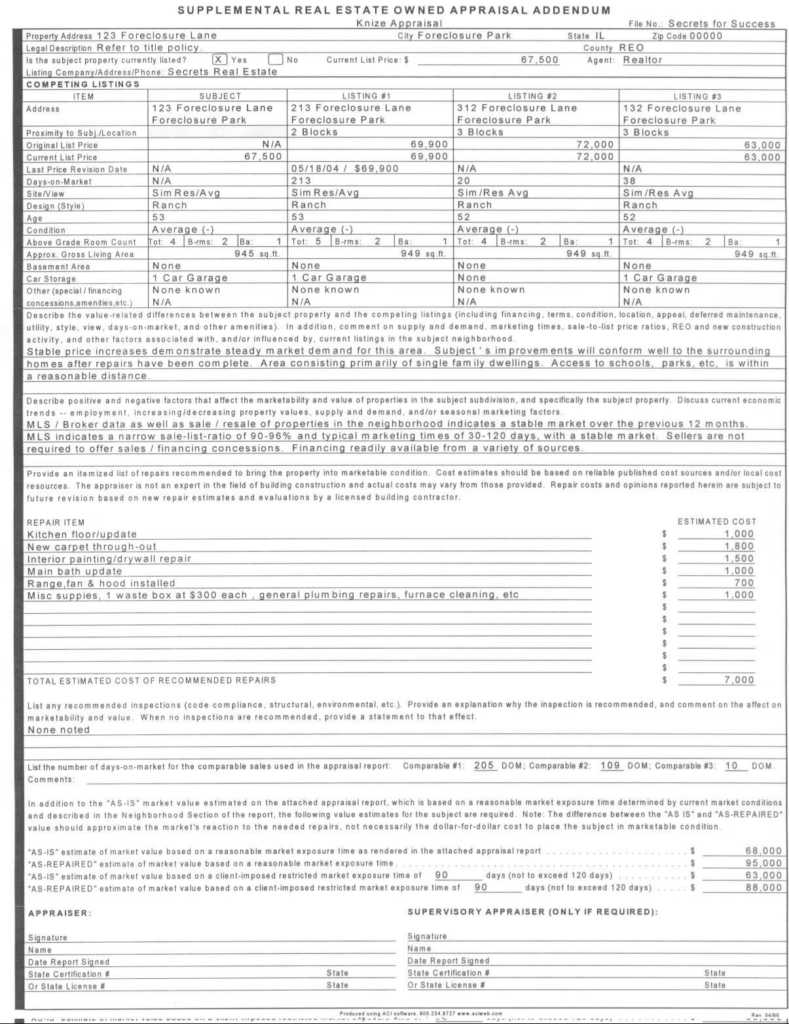

With an REO property appraisal, as an appraiser, I had to complete a regular full appraisal and a Supplemental Real Estate Owned Addendum.

The REO Addendum is detailed information on the foreclosure property, the listed price on the property if any and listings of competing properties for sale in the general marketing area.

Foreclosures Often Resell For 50-100% Over Their Original Sales Price

The REO Addendum would also include a total estimated cost of recommended repairs. Finally, the REO Addendum required and “as-is” estimated value, an “as-is” repaired estimated value, an “as-is” estimated market value based on a minimal exposure time in the market and an as-is repaired value.

What fascinated me the most was when I would see foreclosures resell for 50-100% over the original sales price. That’s exactly why I started Flipping Houses myself!

Foreclosures are historically more abundant in lower income areas rather than higher income areas. The percentage of foreclosures typically decreases as the price increases in an area.

When a lender has an REO, it reflects negative on their books and is considered a liability not an asset. If a lender has too many REO’s on their books, a lender can become very motivated to sell which in turn provides an investor with an opportunity.

Buying an REO is a great way to obtain a property. The investor usually gets a clear title and they are typically cleaned out prior to being shown. Often, they are priced far below market value to reflect needed repairs and deferred maintenance.

After a lender takes back a property through the foreclosure process, they are often listed through a real estate agent.

In my experience, I have discovered that many agents are from outside of the general marketing area of the property. When this occurs, the realtor may not have the expertise to list the property appropriately.

The property is often listed above or below market value. When listed below market value, this opens the door for investors to reap a nice profit. But it can also open the door for many investors and contracts may come in too high. This will chip away at your profit margin and can even put you in the red upon selling.

There may be different processes in place for bidding on foreclosures. Some processes are very simple. For example, you contact the agent, asking for a showing and if interested, you put in a sales contract. However, there are other processes that are more tedious.

As a certified appraiser and a real estate broker, I recently had a friend who inquire about a property in his area. It appeared to be vacant and possibly foreclosed on. It was listed for sale and he was interested in placing a contract on the property.

In order for us to put in a contract, we had to sign up to a specific portal online and upload documents. Once we submitted the documents, we received a simple “Submission Accepted”.

It took several attempts to get through to the agent to find out about our offer. It was a lot of red tape to get a simple response. As it turns out, the property received multiple contracts.

Are All Foreclosures Good Deals?

No, not all foreclosures are good deals! Sometimes properties are listed over their market value and the price drops several times before having market reaction and selling.

Properties can be listed, cancelled and re-listed for long periods of time and often remaining on the market for over a year.

For example, a lender may have a property that has been neglected by its owner and the property has depreciated significantly. It is in need of major renovations.

The property is worth $50,000 but the lender has a $100,000 loan on its books. The lender isn’t ready to absorb a $50,000 loss so it’s sits on the market. In many cases, the property is listed and re-listed each time with a decreased asking price until market reaction presents itself.

Do your own homework and also work with local realtors to get an accurate value of a property prior to placing a contract.

Finding your diamond in the ruff foreclosure can be as easy as contacting a local real estate office. Consider contacting an office in the same area as the properties you are potentially looking to rehab. An experienced agent can provide you new listings of foreclosures on the market.

When Searching for a Real Estate Agent to Locate Foreclosures, Ask the Appropriate Questions.

- Are you familiar with foreclosures in the area?

- How long have you had this experience?

- Are you currently listing and selling foreclosed properties?

- Are you aware of properties that are in pre-foreclosure?

- Can you offer me insight in this current market?

Indicate to the agent that you are a real estate investor and that you flip houses. Tell the agent that you are interested in possibly buying and selling properties with them. If you are serious, a credible agent should be willing to assist you.

Agents are paid on commission and buyers agents typically average 2.5% at the closing. A $100,000 sale is a hefty $2,500. This is one of the reasons I decided to become a broker myself.

Although it’s important to use a realtor to understand the market, it’s more important for you to gain expertise. Knowing the area you are investing in, just as a mail person knows their route, is critical to your success.

Driving or farming an area is a good way to learn the market. Attempt to locate new properties coming into the market and the prices of closed sales. Visit real estate offices and contact agents directly on real estate signs. To familiarize yourself with the market, ask agents for a list of sold properties.

Obtain your own information on listings and sold properties by Google searching the area by town or zip code. You can also go directly to popular sites such as Zillow or Redfin.

Do not be discouraged if you do not catch a property the day of or the next day it goes on the market. Because Lenders often have their agents submit all contracts only after the property has had a reasonable amount of exposure to the open market.

Finding the right foreclosure to buy is just a numbers game. You only want to rush into a contract if you are 100% sure! Remember, you make money when you buy, not when you sell. This is important to remember each time when you flip houses.

You Need To Know The Numbers!

- How sure are you about the “as is value”

- Do you know the “after repair value” ARV

- What are the “as is” Comparables in the area selling for?

- What are the similar rehabbed properties in the area selling for?

- What are the marketing times for those rehabbed properties?

- How long are properties sitting before they have a contract & then close?

- What are the repair costs? Always assume more repairs than less – add 10-20% on top of your estimate%.

- Don’t forget about closing costs, realtor costs and tax credits when you sell. They add up quickly!

These are the questions you need to ask yourself before placing a contract on a property. Your due diligence is going to make or break your deal. Good luck!