Have you ever thought of buying and selling foreclosed homes for profit? Did you think there was just too much competition or thought it would be too complicated? Well, flipping foreclosures is not for everyone I can tell you that for sure. Did you think I was going to sugarcoat it for you?

If only gave you the candy coated version, you might jump into this new venture thinking everyone that bought and sold a foreclosure made a $50,000-$100,000 net profit. It’s further from the truth. But if you educate yourself, you’re quick to act and you’re diligent, you can do well.

The 411 On Shows Like Property Ladder & Flip This House

In the past, shows like Property Ladder and Flip This House would show common people buying distressed foreclosed properties. They would attempt to fix and flip these homes for a tidy profit. But at the end of each show, the homes were listed for sale and often these properties wouldn’t sell at all. They would even flash forward several weeks and months. The homes didn’t sell even after being rehabbed!

Don’t get me wrong. There are people making small and large profit from flipping houses on these shows.

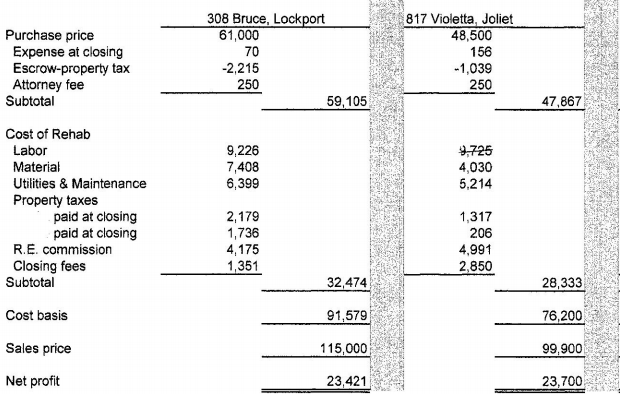

Personally, I have made net profits between $20,000-$25,000 on many properties. The profit may seem low but these properties were low end homes in the range between $45,000-$65,000.

These two houses were sold at $115,000 and $99,900. Remember, net profit is expected to be higher with increasing prices and risk.

In order to get an edge in securing deals on these houses, I didn’t use my real estate agent friend or a family member. I contacted the listing agent directly.

This strategy is discussed in another flipping houses post that I wrote here: Use Listing Agents To Get An Edge For Flipping Houses

I offer these details in an attempt to give you the reality. And speaking of reality, recent shows such as Flipping Las Vegas give you the quick and easy details – Purchase price, rehab cost and sales price. There are many details left out such as holding costs, closing costs, real estate commissions and taxes.

Buying Foreclosures While The Borrower Is In Default (not the easiest way)

After a borrower is in default of their obligation, the lender will file a notice of default. Lenders are required to offer the borrower 90 days to make good on the loan. This 90-day period is referred to as a redemption period. After this period, a lender must advertise the property in a legal newspaper for 21 days. To locate this paper, you can call or go to the county courthouse for guidance.

If you locate properties that interest you, determining the market value is the next step. It will be difficult to get a clear indication of the market value until you actually get inside the property. At that point you need to make a cost to cure list on the physical depreciation.

In order to track down the homeowner you can try by telephone, soliciting the property, or by leaving a business card or letter. This can be a difficult task in getting the owner to respond. However, if you have the gumption you should go for it. You might just strike a deal!

If you are able to locate or talk to an owner, you will need to be delicate and make it all about what you can do for them! After all, they are more than likely having a difficult time in their life. When talking to the owner you will need to find out what is presently owed on the property.

For example: If the market value of the property is $150,000 and there is $75,000 owed, that may present a great opportunity. It will depend on the condition and rehab costs.

On the flip side, if the property is worth $75,000 and $150,000 is owed, the investment would certainly not be in your best interest!

Many times when buying in this situation, there will be competition lurking around the corner. The current owner could be working with other investors and playing the market themselves. Therefore, it is imperative to stand out from the crowd with your character and to have a plan of action.

Buying At Auction (this can be tricky, still not the easiest method)

If a lender uses judicial foreclosure to recover debt, an advertisement for the sale of the foreclosed property and a public auction will occur. Anyone can attend the auction to observe or bid. However, in most cases the lender is the highest bidder. The lender has the mortgage dept as a bid and needs no additional moneys. We as bidders must have cash or pre-arranged financing.

You can find out about upcoming auctions in your area by checking the real estate section in your local papers, contacting the county courthouse, or by searching the Internet. There is usually an ample amount of time to view the property prior to auction.

If you are interested in the approach of auction buying, it would behoove you to stay on the sidelines and observe for several weeks. You may even want to locate a mentor or experienced professional in auction buying. This will allow you to fully understand the auction process prior to bidding.

Buying Directly From The Lender (buy from small banks to increase success)

All lenders, large and small, have REO properties on their inventory. They do not advertise their misfortune due to it being a negative reflection on their business.

Buying directly from the lender is not an easy task. It can be somewhat intimidating walking into an institution and asking for information on REO properties. In most instances the bank or lender won’t even know what you are looking for and turn you away.

In order to increase your chance of success in this department, try working with a bank or lender that you have some type of relationship with. A good start is the bank that you or members of your family currently do business with. It is more likely for an REO department to work with one of its customers or a referred family member of one of its customers.

Small Non-Franchised Local Banks To Buy Foreclosures

Although I haven’t bought properties directly from small banks myself, I heard others doing so. One of my appraiser friends recently met an investor while on an appraisal. The investor was kind enough to share his investment strategy for buying foreclosures.

He buys several properties directly from local mom and pop type banks. Basically, he is buying from the banks that you and I have probably never heard of. He doesn’t even attempt to walk-in the big institutions like Chase, Wells Fargo or Bank of America.

That is his strategy! The small banks give him a loan for the property too. He doesn’t have to buy for all cash.

Buying Foreclosures Before Going On Multiple Listing Service

Realtors that list properties for lenders receive the property location and useful data in advance. I used to frequently receive information on properties from the agent prior to the properties being listed.

How did I get this information? I contacted several agents. One agent told me about a list of future properties they had coming in. I was like a kid in a candy store checking that list!

This gives you a huge edge over the competition! Because the list isn’t on the MLS so it will be limited to fewer people. Buyers agents and potential buyers likely won’t even have access to the list until the property listed on the market.

Locating the right real estate agent is key! Once you find an agent that specializes in listing foreclosures, they will be more than happy to send you the property information prior to completing the formal listing. As a broker myself, I know that the more connections you make, the more money you make.

Buying Foreclosures After The Multiple Listing Service

By far, this is the easiest way to find a foreclosure but it is usually the most competitive.

Real estate agents list foreclosures as they receive them from lenders. You could search Zillow or drive areas to find distressed properties for sale.

If you find a property as soon as it enters the market, in my opinion, you are best to contact the agent from the sign directly.

- You will find the greatest number of foreclosures on the Multiple Listing Service.

Why Are Most Foreclosures On The MLS?

Answer: Because there are approximately 1.4 million realtors in the United States alone. Most lenders are more likely to use a trusted and licensed agent to handle their distressed properties.

Lenders also know that an agent has a vast amount of resources such as access to the MLS. Foreclosures will likely sell much faster with an agent vs. if they handled the properties themselves.

A Work Of Caution

- Many foreclosures are overpriced

- All foreclosures are not good deals

- Often good deals have multiple contracts

- Good deals can significantly inflate prices

- Seasoned investors are fierce competitors

All foreclosures aren’t the ugly duckling homes that you might think.

Homeowners in all walks of life lose their homes due to some unforeseen reason such as job loss, divorce or a death in the family.

This means that houses get foreclosed on in the $50,000 price range and the $1,000,000+ price range.

Sure the foreclosures are more prominent in the lower price range but they are still significant in the median range.

If you are selling your home in the future, you might want to consider buying a foreclosure.

Just be sure to due your due diligence. Also, think twice about buying a short sale due to the long and drawn out process.

I hope this post gave you some solid advice in the world of buying foreclosures. Please like it and share it, if you liked it! (-: